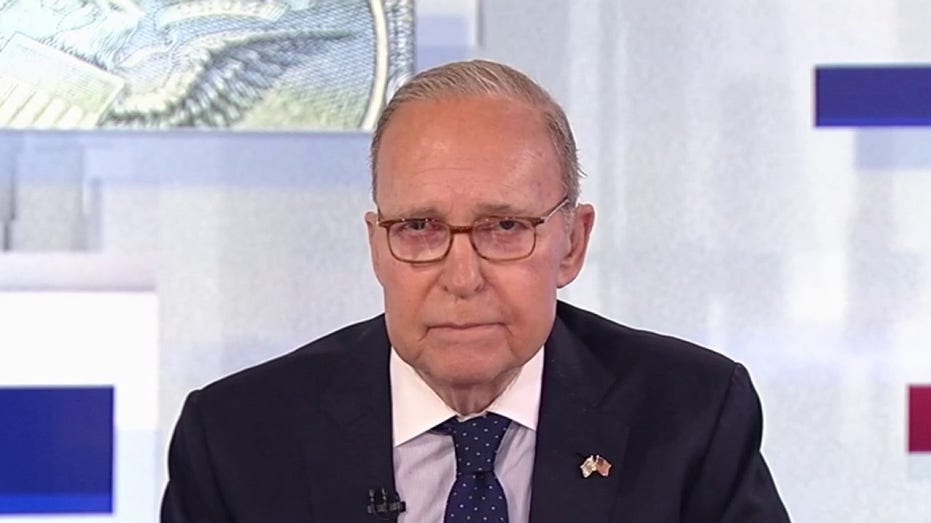

FOX Enterprise host Larry Kudlow discusses how the tax minimize invoice will assist deficit discount on ‘Kudlow.’

Based on the Congressional Price range Workplace (CBO), President Donald Trump’s “huge, lovely invoice” would minimize taxes by $3.7 trillion whereas elevating deficits by $2.4 trillion over a decade.

The CBO makes projections primarily based on info offered by Congress when contemplating laws that features spending and taxes. However is it at all times proper?

Not in line with Larry Kudlow. Throughout his present on Thursday, Kudlow outlined how the Congressional Price range Workplace missed projections associated to the 2017 Tax Minimize and Jobs Act, Trump’s signature invoice in his first time period.

“The present value of the 2017 tax cuts must be zero. Why ought to they be zero? As a result of they really produced extra revenues, $2.3 trillion extra revenues than CBO estimated over the previous seven years,” Kudlow stated.

TRUMP SPENDING BILL WOULD CUT TAXES BY $3.7T, ADD $2.4T TO DEFICIT, CBO SAYS

President Donald Trump takes a query from a reporter within the Oval Workplace on the White Home on Might 5. (Anna Moneymaker/Getty Photos / Getty Photos)

He added, “So present coverage should not be scored. The deficit affect must be impartial. Now, I consider there can be a development dividend which can be debatable, but when I plug in 3% development as an alternative of the CBO’s lowball 1.8%, then I truly get $4 trillion price of extra revenues for functions of deficit discount.”

Kudlow continued, providing up some caveats, however noting the CBO’s estimates depend on GDP of 1.8%, which is a low determine.

“You’ll be able to play with these numbers interactively. If you happen to decrease the expansion dividend, for example to 2.6%, you may in all probability lose as much as two trillion in revenues and deficit discount,” he stated. “Or if you wish to use CBO’s dreary 1.8% development, you’d in all probability lose the entire 4 trillion in extra revenues and deposit discount.”

Kudlow famous, “You’d nonetheless come out forward on the deficit discount scorecard, however simply not as a lot. However importantly, the GOP will forestall a $4 trillion tax hike, which might be catastrophic for the financial system.”

ELON MUSK SLAMS GOP TAX BILL OVER DEFICIT IMPACT: ‘DISGUSTING ABOMINATION’

Based on Kudlow, it’s not the one time the CBO has missed estimates. For instance, with the Inexpensive Care Act, the CBO initially estimated as much as 25 million folks would join healthcare on the Obamacare exchanges by 2017. The precise determine in 2017 was solely 12 million, a big miss of 13 million folks.

Additionally famous have been the potential financial savings from the 2022 Inflation Discount Act. The CBO initially estimated billions in deficit discount, however the newest estimates present it might add $428 billion to the deficit. The CBO made such projections assuming that the extra important tax cuts within the 2017 package deal would expire on the finish of 2025.

Whether or not the Home model of ‘A Large Stunning Invoice’ passes and is in the end signed is up within the air. Within the Senate, two Republicans, Rand Paul, R-Ky., and Ron Johnson, R-Wis., have indicated dissatisfaction with the invoice resulting from a scarcity of deficit reduction.

UNITED STATES – JUNE 1: Sen. Rand Paul, R-Ky., talks with reporters within the U.S. Capitol because the Senate works on the debt restrict invoice on Thursday, June 1, 2023. (Tom Williams/CQ-Roll Name, Inc. through Getty Photos / Getty Photos)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Republicans wish to go the invoice within the Senate utilizing reconciliation, which solely requires a easy majority of 51 votes as an alternative of getting to achieve a cloture vote of 60. With a 53-47 majority, Republicans can’t threat greater than two defections, or the invoice can be defeated.

Source link